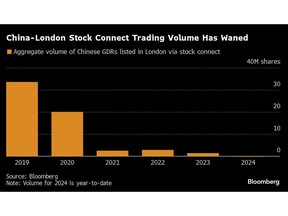

(Bloomberg) — For years, the London Stock Exchange touted a link with China’s equity markets as an initiative that would give global investors access to the Asian nation’s growth through the UK. Yet almost five years since the mechanism was introduced, it has dropped off the radar. Just six Chinese companies have listed in London since the Shanghai-London stock connect began, and trading has been muted.

Meanwhile, no European companies have listed in China. In the London Stock Exchange Group Plc’s last three annual reports, the cross-border program garnered zero mentions despite its expansion to Shenzhen. The state of the program shows how China has evolved from being one of the world’s hottest stock markets to one that’s weighed down by a sluggish economy and mounting trade and political tensions.

And it also reflects the London market’s faded appeal to investors, something it hopes to start reversing if it can lure online fashion retailer Shein to hold an initial public offering in the UK. “It probably took years to agree upon the framework and the infrastructure for this,” Mike Werner, an analyst at UBS Global Research, said of the stock link. “So to go through that process with ultimately the end result being only six listed companies — I don’t know if that’s a return on investment that they would have traveled down, had they known about ultimately the potential lack of demand.

” The world has become more divided since the listing of Huatai Secu.